During the COVID-19 pandemic, many New York homeowners took advantage of state or federal forbearance programs under the CARES Act, which allow pauses in mortgage payments. Now, as New York and the nation recover from the pandemic, those homeowners may …

Read More

New York State has enacted a new moratorium on COVID-related residential and commercial evictions. Yet, the prospect of facing foreclosure and eviction sometime in 2022 or sooner remains real for many who have fallen behind on their mortgages. Many New York …

Read More

One method for avoiding foreclosure on your home if you are behind on mortgage payments is to ask your lender to modify your loan to make the monthly payments more manageable. If your home loan is insured by the Federal …

Read More

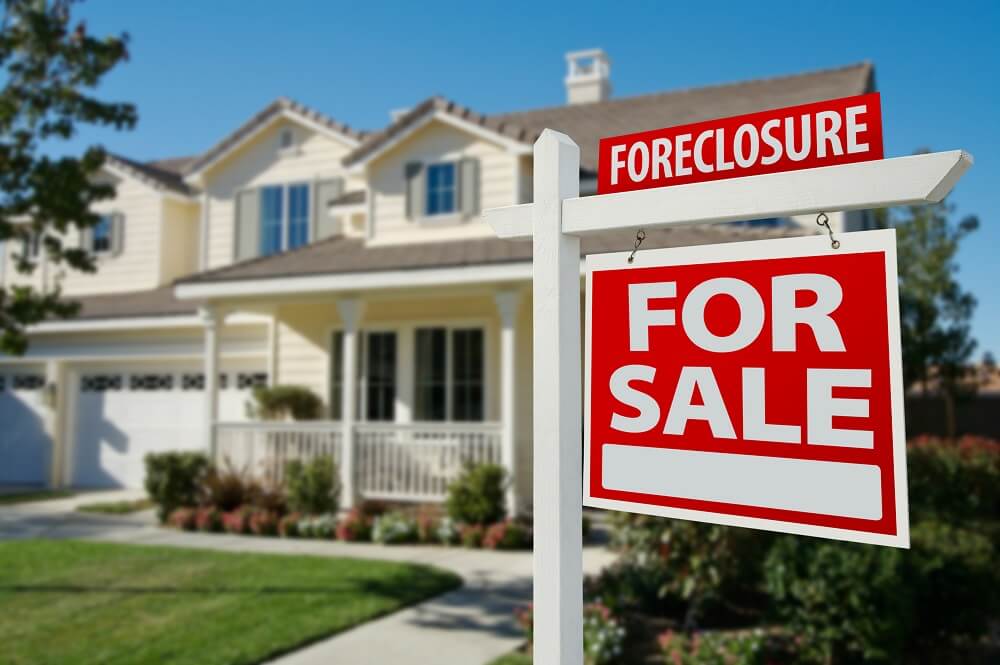

With COVID-connected moratoriums on mortgage foreclosures in New York in the news, some homeowners in difficult financial situations may ask how the foreclosure process proceeds in New York. The good news for those who are behind on their mortgages is …

Read More

When purchasing a home, the thought of foreclosure is the last thing on your mind. As you sign repeatedly on all those dotted lines, you’re confident that you’ll have the resources needed to make each payment on time and one …

Read More

If you fall behind on your mortgage payments, and the bank or servicer or other lending institution threatens to foreclose on your home, you should contact attorney Michael H. Schwartz as soon as possible. In his 40 years as a …

Read More

If you start to fall behind on your mortgage payments in New York, foreclosure could be just around the corner. In other words, your lender could soon try to take possession of your home and sell it. If the sale …

Read More

By September 2010, the foreclosure crisis in the United States hit its peak. Also referred to as the housing crisis, the foreclosure crisis began in 2007 and was exactly what it sounds like: the homes of millions of Americans were …

Read More

In the latest of a long line of successful mortgage modifications, Michael H. Schwartz has been awarded the highest hourly rate ever in a mortgage modification by Chief Judge Cecilia G. Morris, United States Bankruptcy Court. The fees will be …

Read More

If you’re facing foreclosure, you’re probably looking for options – and a mortgage loan modification might be one choice on the menu. In a mortgage loan modification, one or more of the requirements of a loan are changed so that …

Read More